Alternatif Bank Mobile Has Been Renewed!

You can download the renewed Alternatif Bank Mobile to your device via the App Store, Google Play Store and Huawei App Gallery.

You can make your banking transactions at our ATMs 24 hours and 7 days a week without waiting in the line.

To start using Alternatif Bank ATMs, you need to become an Alternatif Bank customer and have one of Alternatif Bank’s debit or credit cards.

You can view our transaction limits and hours for your Alternatif Bank ATM transactions in the table below.

| Transaction | Transaction Limits (TRY) | |

| Minimum Limit | Maximum Limit | |

| Cash Withdrawal (TRY) | 10 TL | 1.500 TL |

| Cash Advance | 50 TL | 4.000 TL |

| Instalment Cash Advance | 50 TL | 4.000 TL |

| Cash Deposit (Daily) | 5 TL | 20.000 TL |

| Cash Credit Card Debt Payment (Outright) | 5 TL | 8.000 TL |

| Transfer (Between One’s Accounts) | 0,01 TL | Sınırsız |

| Transfer (Between Alternatif Bank Accounts) | 0,01 TL | 100.000 TL |

| EFT (Daily, to Assigned Recipients) | 1 TL | 50.000 TL |

| Other Bank Card Debt Payment (Daily) | 5 TL | 20.000 TL |

| Other Credit Bank Card Debt Payment (Daily) | 5 TL | 20.000 TL |

Here you may find frequently asked questions about Alternatif Bank ATMs

To start using Alternatif Bank ATMs, you need to become an Alternatif Bank customer and have one of Alternatif Bank’s debit or credit cards.

If your card gets stuck or is withheld in the ATM, do not get help from anyone who may offer to assist you and call our Call Centre at +90 444 00 55 immediately.?

You can download the renewed Alternatif Bank Mobile to your device via the App Store, Google Play Store and Huawei App Gallery.

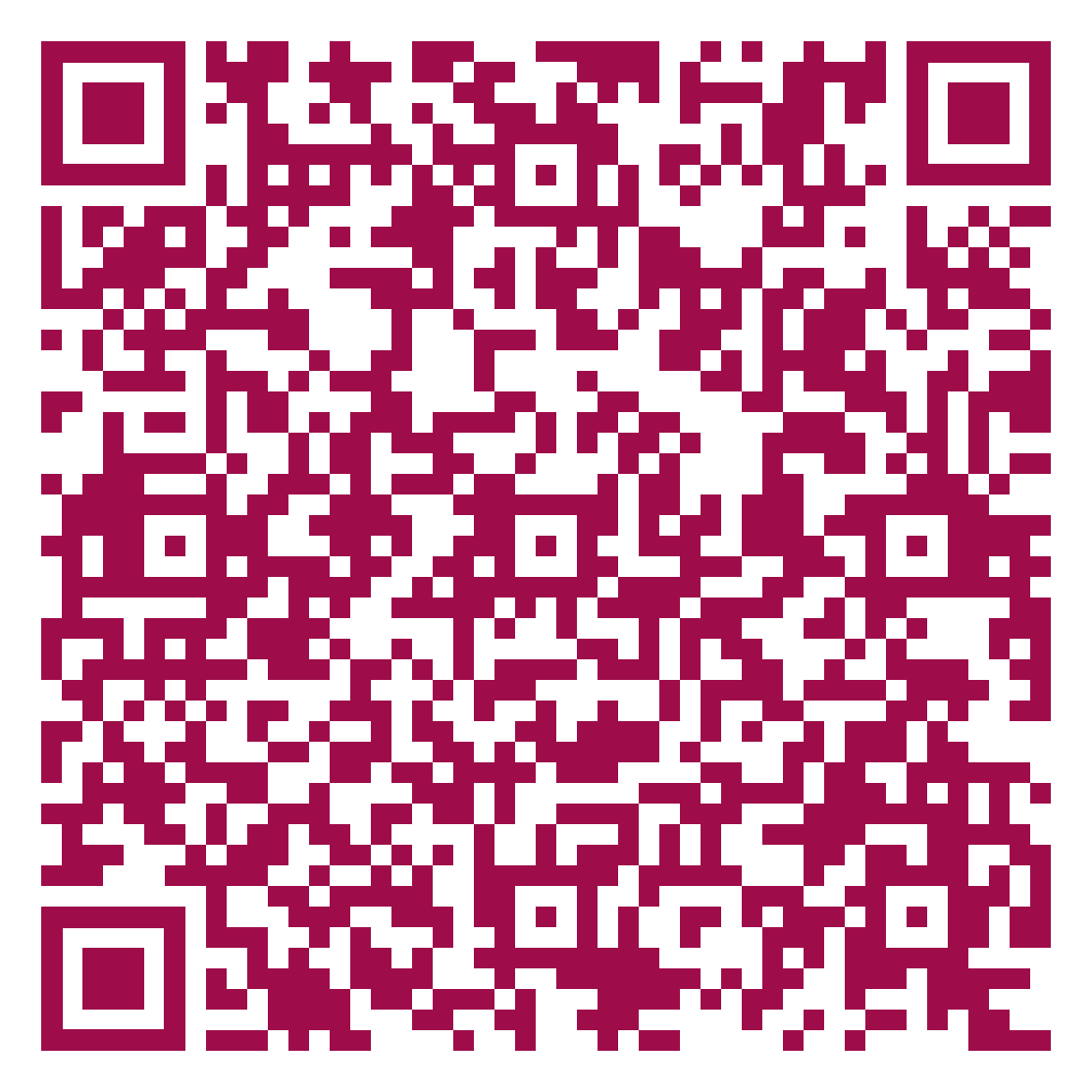

You can download the Alternatif Bank Mobile application right away by scanning the QR code.

You can download the Alternatif Bank Mobile application right away by scanning the QR code.